The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

ing system of the

United States of America

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territo ...

. It was created on December 23, 1913, with the enactment of the

Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, after a series of

financial panic

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

s (particularly the

panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from ...

) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

in the 1930s and the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of a ...

established three key objectives for

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and

regulating banks, maintaining the stability of the financial system, and providing financial services to

depository institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumer

...

s, the U.S. government, and foreign official institutions.

The Fed also conducts research into the economy and provides numerous publications, such as the

Beige Book

The Beige Book, more formally called the Summary of Commentary on Current Economic Conditions, is a report published by the United States Federal Reserve Board eight times a year. The report is published in advance of meetings of the Federal Open ...

and the

FRED database

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer pri ...

.

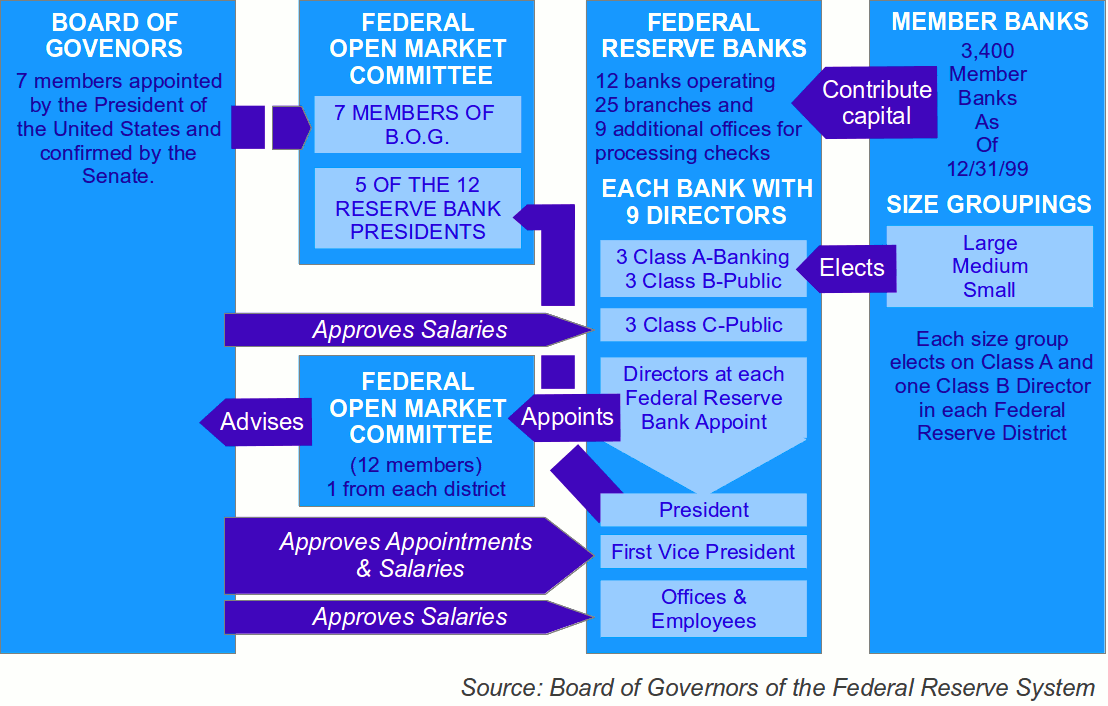

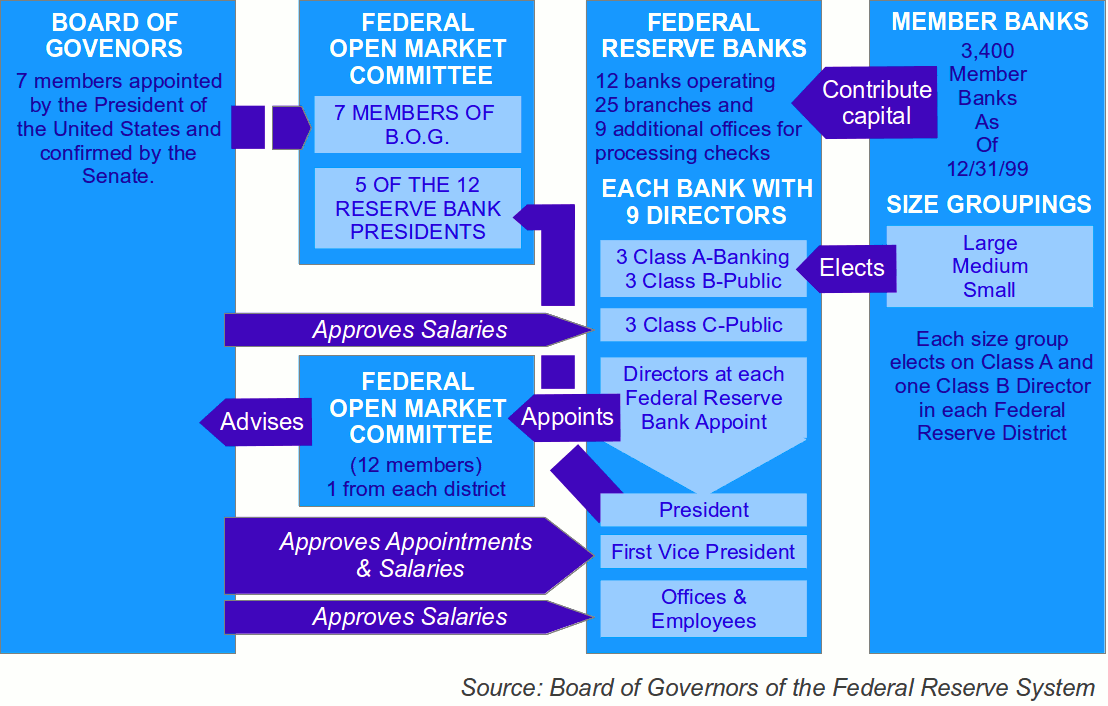

The Federal Reserve System is composed of several layers. It is governed by the presidentially-appointed

board of governors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organi ...

or Federal Reserve Board (FRB). Twelve regional

Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s, located in cities throughout the nation, regulate and oversee privately-owned commercial banks. Nationally chartered commercial banks are required to hold stock in, and can elect some board members of, the Federal Reserve Bank of their region.

The

Federal Open Market Committee

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treasur ...

(FOMC) sets monetary policy. It consists of all seven members of the board of governors and the twelve regional Federal Reserve Bank presidents, though only five bank presidents vote at a time—the president of the

New York Fed and four others who rotate through one-year voting terms. There are also various advisory councils. It has a structure unique among central banks, and is also unusual in that the

United States Department of the Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

, an entity outside of the central bank, prints the

currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general def ...

used.

The federal government sets the salaries of the board's seven governors, and it receives all the system's annual profits, after dividends on member banks' capital investments are paid, and an account surplus is maintained. In 2015, the Federal Reserve earned a net income of $100.2 billion and transferred $97.7 billion to the U.S. Treasury,

and 2020 earnings were approximately $88.6 billion with remittances to the U.S. Treasury of $86.9 billion. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the President or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms."

Purpose

The primary declared motivation for creating the Federal Reserve System was to address

banking panics.

[ "Just before the founding of the Federal Reserve, the nation was plagued with financial crises. At times, these crises led to 'panics,' in which people raced to their banks to withdraw their deposits. A particularly severe panic in 1907 resulted in bank runs that wreaked havoc on the fragile banking system and ultimately led Congress in 1913 to write the Federal Reserve Act. Initially created to address these banking panics, the Federal Reserve is now charged with a number of broader responsibilities, including fostering a sound banking system and a healthy economy."] Other purposes are stated in the

Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, such as "to furnish an elastic currency, to afford means of rediscounting

commercial paper

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. In layperson terms, it is like an " IOU" but can be bought and sold because its buyers and sellers have some ...

, to establish a more effective supervision of banking in the United States, and for other purposes". Before the founding of the Federal Reserve System, the United States underwent several financial crises. A particularly severe crisis in 1907 led Congress to enact the Federal Reserve Act in 1913. Today the Federal Reserve System has responsibilities in addition to stabilizing the financial system.

Current functions of the Federal Reserve System include:

* To address the problem of

banking panics

* To serve as the

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

for the United States

* To strike a balance between private interests of banks and the centralized responsibility of government

** To supervise and regulate banking institutions

** To protect the credit rights of consumers

* To manage the nation's

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

through

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

to achieve the sometimes-conflicting goals of

** maximum employment

** stable prices, including prevention of either

inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

or

deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation ...

** moderate long-term interest rates

* To maintain the stability of the financial system and contain

systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the ...

in financial markets

* To provide financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation's payments system

** To facilitate the exchange of payments among regions

** To respond to local liquidity needs

* To strengthen U.S. standing in the world economy

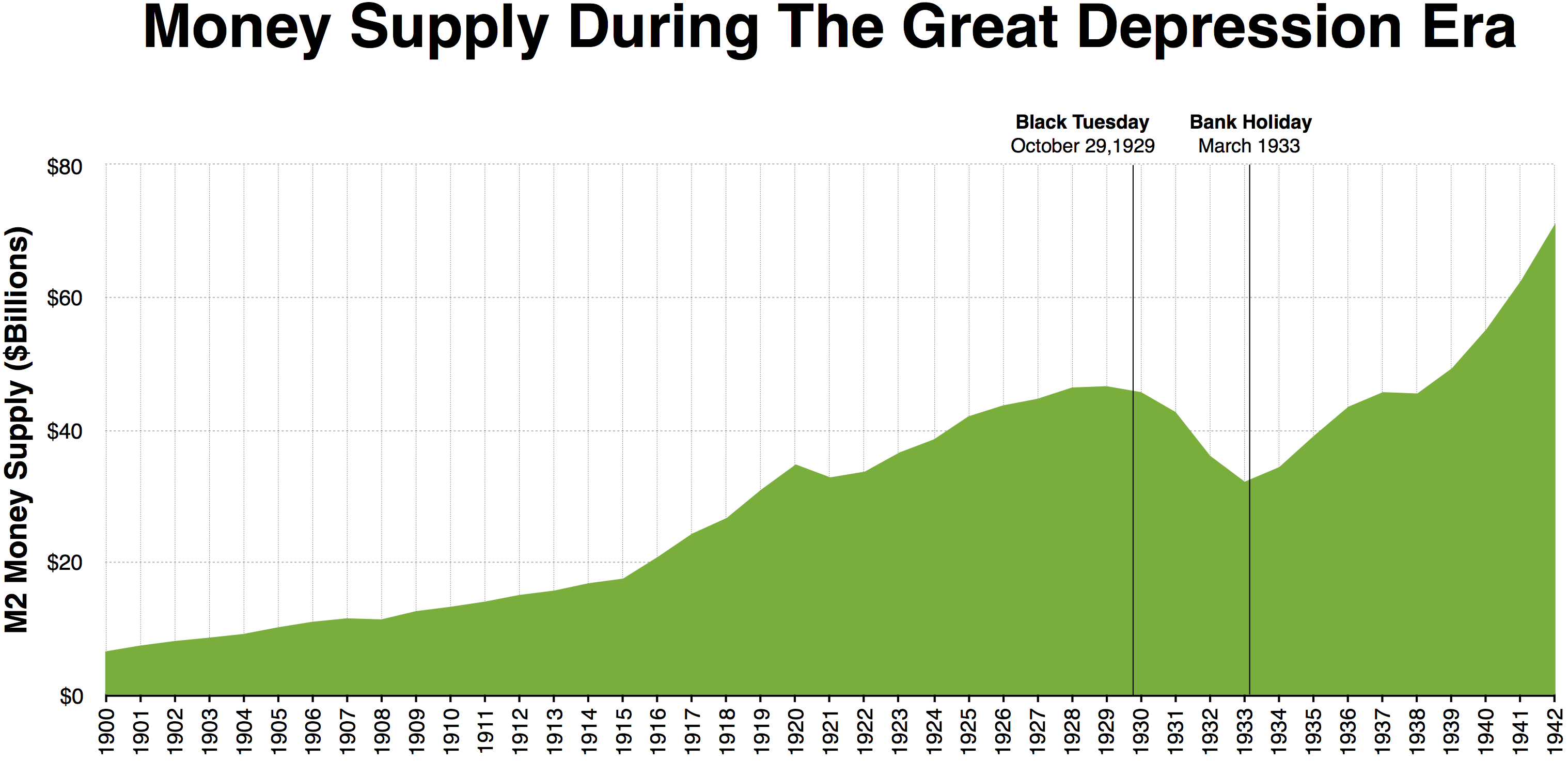

Addressing the problem of bank panics

Banking institutions in the United States are required to hold reservesamounts of currency and deposits in other banksequal to only a fraction of the amount of the bank's deposit liabilities owed to customers. This practice is called

fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

. As a result, banks usually invest the majority of the funds received from depositors. On rare occasions, too many of the bank's customers will withdraw their savings and the bank will need help from another institution to continue operating; this is called a

bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

. Bank runs can lead to a multitude of social and economic problems. The Federal Reserve System was designed as an attempt to prevent or minimize the occurrence of bank runs, and possibly act as a

lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

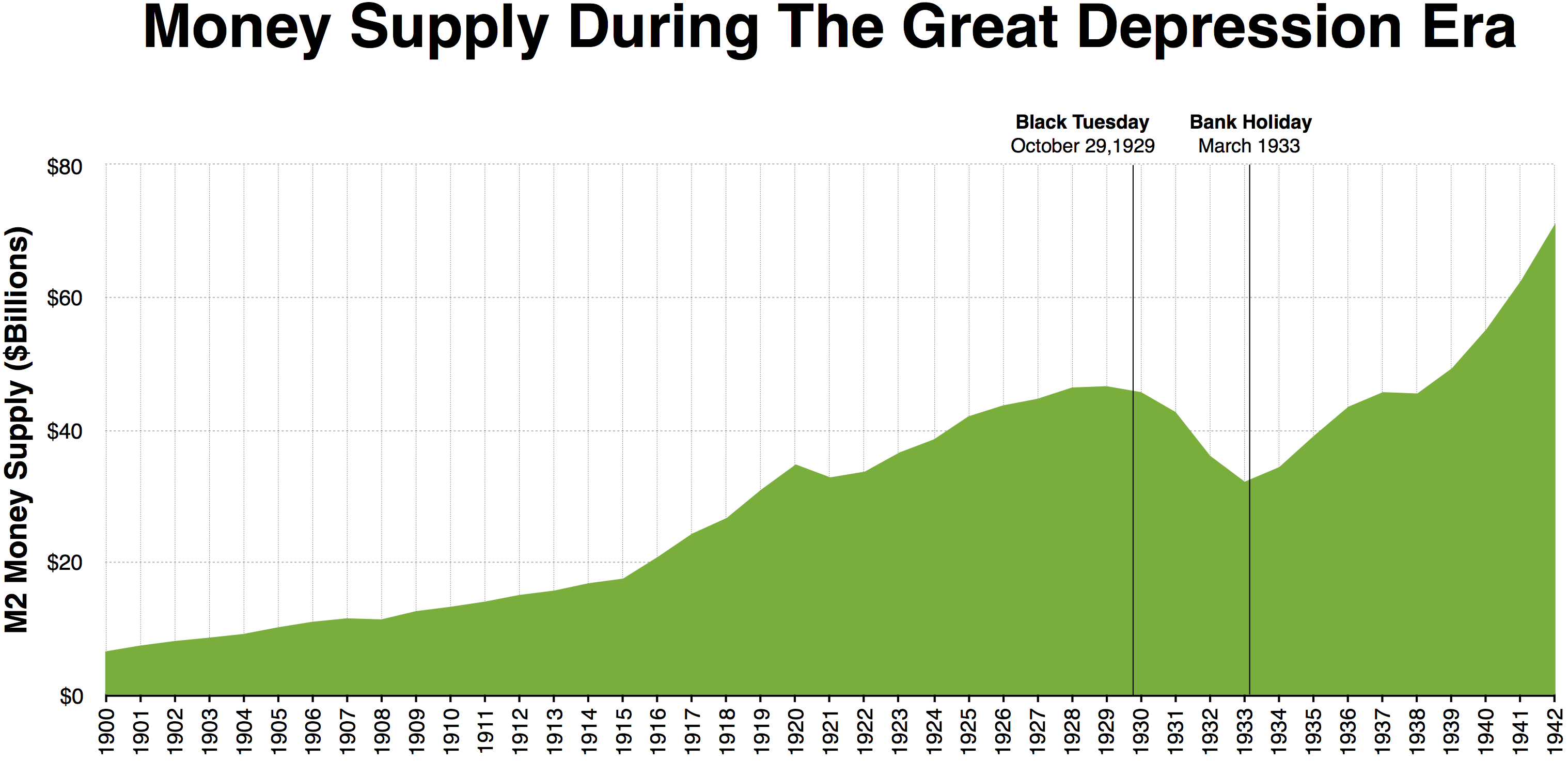

when a bank run does occur. Many economists, following

Nobel laureate

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

, believe that the Federal Reserve inappropriately refused to lend money to small banks during the bank runs of 1929; Friedman argued that this contributed to the

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

.

[; FRB Speech]

FederalReserve.gov: Remarks by Governor Ben S. Bernanke, Conference to Honor Milton Friedman, University of Chicago, Nov. 8, 2002

Check clearing system

Because some banks refused to

clear checks from certain other banks during times of economic uncertainty, a check-clearing system was created in the Federal Reserve System. It is briefly described in ''The Federal Reserve SystemPurposes and Functions'' as follows:

Lender of last resort

In the United States, the Federal Reserve serves as the

lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

to those institutions that cannot obtain credit elsewhere and the collapse of which would have serious implications for the economy. It took over this role from the private sector "clearing houses" which operated during the

Free Banking Era

This history of central banking in the United States encompasses various bank regulations, from early wildcat banking practices through the present Federal Reserve System.

1781–1836: Bank of North America and First and Second Bank of the Uni ...

; whether public or private, the availability of liquidity was intended to prevent bank runs.

Fluctuations

Through its

discount window

The discount window is an instrument of monetary policy (usually controlled by central banks) that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by ...

and credit operations, Reserve Banks provide liquidity to banks to meet short-term needs stemming from seasonal fluctuations in deposits or unexpected withdrawals. Longer-term liquidity may also be provided in exceptional circumstances. The rate the Fed charges banks for these loans is called the discount rate (officially the primary credit rate).

By making these loans, the Fed serves as a buffer against unexpected day-to-day fluctuations in reserve demand and supply. This contributes to the effective functioning of the banking system, alleviates pressure in the reserves market and reduces the extent of unexpected movements in the interest rates.

For example, on September 16, 2008, the Federal Reserve Board authorized an $85 billion loan to stave off the bankruptcy of international insurance giant

American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/amer ...

(AIG).

[; ]

Central bank

In its role as the

central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

of the United States, the Fed serves as a banker's bank and as the government's bank. As the banker's bank, it helps to assure the safety and efficiency of the payments system. As the government's bank or fiscal agent, the Fed processes a variety of financial transactions involving trillions of dollars. Just as an individual might keep an account at a bank, the

U.S. Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

keeps a checking account with the Federal Reserve, through which incoming federal tax deposits and outgoing government payments are handled. As part of this service relationship, the Fed sells and redeems

U.S. government securities such as savings bonds and Treasury bills, notes and bonds. It also issues the nation's

coin

A coin is a small, flat (usually depending on the country or value), round piece of metal or plastic used primarily as a medium of exchange or legal tender. They are standardized in weight, and produced in large quantities at a mint in order t ...

and

paper currency

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

. The U.S. Treasury, through its

Bureau of the Mint and

Bureau of Engraving and Printing

The Bureau of Engraving and Printing (BEP) is a government agency within the United States Department of the Treasury that designs and produces a variety of security products for the United States government, most notable of which is Federal Rese ...

, actually produces the nation's cash supply and, in effect, sells the paper currency to the Federal Reserve Banks at manufacturing cost, and the coins at face value. The Federal Reserve Banks then distribute it to other financial institutions in various ways.

During the

Fiscal Year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many ...

2013, the Bureau of Engraving and Printing delivered 6.6 billion notes at an average cost of 5.0 cents per note.

Federal funds

Federal funds are the reserve balances (also called

Federal Reserve Deposits) that private banks keep at their local Federal Reserve Bank. These balances are the namesake reserves of the Federal Reserve System. The purpose of keeping funds at a Federal Reserve Bank is to have a mechanism for private banks to lend funds to one another. This market for funds plays an important role in the Federal Reserve System as it is what inspired the name of the system and it is what is used as the basis for monetary policy. Monetary policy is put into effect partly by influencing how much interest the private banks charge each other for the lending of these funds.

Federal reserve accounts contain federal reserve credit, which can be converted into

federal reserve note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s. Private banks maintain their

bank reserves

Bank reserves are a commercial bank's cash holdings physically held by the bank, and deposits held in the bank's account with the central bank. Under the fractional-reserve banking system used in most countries, central banks typically set mini ...

in federal reserve accounts.

Bank regulation

The Federal Reserve regulates private banks. The system was designed out of a compromise between the competing philosophies of privatization and government regulation. In 2006

Donald L. Kohn, vice chairman of the board of governors, summarized the history of this compromise:

The balance between private interests and government can also be seen in the structure of the system. Private banks elect members of the board of directors at their regional Federal Reserve Bank while the members of the board of governors are selected by the

President of the United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United Stat ...

and confirmed by the

Senate

A senate is a deliberative assembly, often the upper house or chamber of a bicameral legislature. The name comes from the ancient Roman Senate (Latin: ''Senatus''), so-called as an assembly of the senior (Latin: ''senex'' meaning "the el ...

.

Government regulation and supervision

The Federal Banking Agency Audit Act, enacted in 1978 as Public Law 95-320 and 31 U.S.C. section 714 establish that the board of governors of the Federal Reserve System and the Federal Reserve banks may be audited by the

Government Accountability Office

The U.S. Government Accountability Office (GAO) is a legislative branch government agency that provides auditing, evaluative, and investigative services for the United States Congress. It is the supreme audit institution of the federal govern ...

(GAO).

The GAO has authority to audit check-processing, currency storage and shipments, and some regulatory and bank examination functions, however, there are restrictions to what the GAO may audit. Under the Federal Banking Agency Audit Act, 31 U.S.C. section 714(b), audits of the Federal Reserve Board and Federal Reserve banks do not include (1) transactions for or with a foreign central bank or government or non-private international financing organization; (2) deliberations, decisions, or actions on monetary policy matters; (3) transactions made under the direction of the Federal Open Market Committee; or (4) a part of a discussion or communication among or between members of the board of governors and officers and employees of the Federal Reserve System related to items (1), (2), or (3). See Federal Reserve System Audits: Restrictions on GAO's Access (GAO/T-GGD-94-44), statement of Charles A. Bowsher.

The board of governors in the Federal Reserve System has a number of supervisory and regulatory responsibilities in the U.S. banking system, but not complete responsibility. A general description of the types of regulation and supervision involved in the U.S. banking system is given by the Federal Reserve:

There is a very strong economic consensus in favor of independence from political influence.

= Regulatory and oversight responsibilities

=

The board of directors of each Federal Reserve Bank District also has regulatory and supervisory responsibilities. If the board of directors of a district bank has judged that a member bank is performing or behaving poorly, it will report this to the board of governors. This policy is described in law:

National payments system

The Federal Reserve plays a role in the U.S. payments system. The twelve Federal Reserve Banks provide banking services to depository institutions and to the federal government. For depository institutions, they maintain accounts and provide various payment services, including collecting checks, electronically transferring funds, and distributing and receiving currency and coin. For the federal government, the Reserve Banks act as fiscal agents, paying Treasury checks; processing electronic payments; and issuing, transferring, and redeeming U.S. government securities.

In the

Depository Institutions Deregulation and Monetary Control Act

The Depository Institutions Deregulation and Monetary Control Act of 1980 (, ) (often abbreviated DIDMCA or MCA) is a United States federal financial statute passed in 1980 and signed by President Jimmy Carter on March 31. It gave the Federal Res ...

of 1980, Congress reaffirmed that the Federal Reserve should promote an efficient nationwide payments system. The act subjects all depository institutions, not just member commercial banks, to reserve requirements and grants them equal access to Reserve Bank payment services.

The Federal Reserve plays a role in the nation's retail and wholesale payments systems by providing financial services to depository institutions. Retail payments are generally for relatively small-dollar amounts and often involve a depository institution's retail clientsindividuals and smaller businesses. The Reserve Banks' retail services include distributing currency and coin, collecting checks, and electronically transferring funds through the automated clearinghouse system. By contrast, wholesale payments are generally for large-dollar amounts and often involve a depository institution's large corporate customers or counterparties, including other financial institutions. The Reserve Banks' wholesale services include electronically transferring funds through the

Fedwire Funds Service and transferring securities issued by the U.S. government, its agencies, and certain other entities through the Fedwire Securities Service.

Structure

The Federal Reserve System has a "unique structure that is both public and private" and is described as "

independent within the government" rather than "

independent of government".

The System does not require public funding, and derives its authority and purpose from the

Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, which was passed by Congress in 1913 and is subject to Congressional modification or repeal.

["Is The Fed Public Or Private?"](_blank)

Federal Reserve Bank of Philadelphia

The Federal Reserve Bank of Philadelphia — also known as the Philadelphia Fed or the Philly Fed — headquartered at 10 Independence Mall in Philadelphia, Pennsylvania, is responsible for the Third District of the Federal Reserve, which covers ...

. Retrieved June 29, 2012. The four main components of the Federal Reserve System are (1) the board of governors, (2) the Federal Open Market Committee, (3) the twelve regional Federal Reserve Banks, and (4) the member banks throughout the country.

Board of governors

The seven-member board of governors is a large federal agency that functions in business oversight by examining national banks. It is charged with the overseeing of the 12 District Reserve Banks and setting national monetary policy. It also supervises and regulates the U.S. banking system in general.

Governors are appointed by the

President of the United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United Stat ...

and confirmed by the

Senate

A senate is a deliberative assembly, often the upper house or chamber of a bicameral legislature. The name comes from the ancient Roman Senate (Latin: ''Senatus''), so-called as an assembly of the senior (Latin: ''senex'' meaning "the el ...

for staggered 14-year terms.

One term begins every two years, on February 1 of even-numbered years, and members serving a full term cannot be renominated for a second term.

[ " on the expiration of their terms of office, members of the Board shall continue to serve until their successors are appointed and have qualified." The law provides for the removal of a member of the board by the president "for cause".][See .] The board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives.

The chair and vice chair of the board of governors are appointed by the president

President most commonly refers to:

*President (corporate title)

*President (education), a leader of a college or university

*President (government title)

President may also refer to:

Automobiles

* Nissan President, a 1966–2010 Japanese ful ...

from among the sitting governors. They both serve a four-year term and they can be renominated as many times as the president chooses, until their terms on the board of governors expire.[See ]

List of members of the board of governors

The current members of the board of governors are:

The current members of the board of governors are:

Nominations, confirmations and resignations

In late December 2011, President Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the U ...

nominated Jeremy C. Stein, a Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher le ...

finance professor and a Democrat

Democrat, Democrats, or Democratic may refer to:

Politics

*A proponent of democracy, or democratic government; a form of government involving rule by the people.

*A member of a Democratic Party:

**Democratic Party (United States) (D)

**Democratic ...

, and Jerome Powell

Jerome Hayden "Jay" Powell (born February 4, 1953) is an American attorney and investment banker who has served as the 16th chair of the Federal Reserve since 2018.

After earning a degree in politics from Princeton University in 1975 and a Jur ...

, formerly of Dillon Read

Dillon, Read & Co. was an investment bank based in New York City. In 1991, it was acquired by Barings Bank and, in 1997, it was acquired by Swiss Bank Corporation, which was in turn acquired by UBS in 1998.

History Carpenter & Vermilye

Dillon Rea ...

, Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

[ and ]The Carlyle Group

The Carlyle Group is a multinational private equity, alternative asset management and financial services corporation based in the United States with $376 billion of assets under management. It specializes in private equity, real assets, and pri ...

and a Republican

Republican can refer to:

Political ideology

* An advocate of a republic, a type of government that is not a monarchy or dictatorship, and is usually associated with the rule of law.

** Republicanism, the ideology in support of republics or agains ...

. Both candidates also have Treasury Department experience in the Obama and George H. W. Bush

George Herbert Walker BushSince around 2000, he has been usually called George H. W. Bush, Bush Senior, Bush 41 or Bush the Elder to distinguish him from his eldest son, George W. Bush, who served as the 43rd president from 2001 to 2009; pr ...

administrations respectively.[Goldstein, Steve (December 27, 2011)]

"Obama to nominate Stein, Powell to Fed board"

''MarketWatch''. Retrieved December 27, 2011.

"Obama administration officials adregrouped to identify Fed candidates after Peter Diamond

Peter Arthur Diamond (born , 1940) is an American economist known for his analysis of U.S. Social Security policy and his work as an advisor to the Advisory Council on Social Security in the late 1980s and 1990s. He was awarded the Nobel Memori ...

, a Nobel Prize-winning economist, withdrew his nomination to the board in June 011in the face of Republican opposition. Richard Clarida

Richard Harris Clarida (born May 18, 1957) is an American economist who served as the 21st Vice Chair of the Federal Reserve from 2018 to 2022. Clarida resigned his post on January 14th 2022 to return from public service leave to teach at Columbi ...

, a potential nominee who was a Treasury official under George W. Bush

George Walker Bush (born July 6, 1946) is an American politician who served as the 43rd president of the United States from 2001 to 2009. A member of the Republican Party, Bush family, and son of the 41st president George H. W. Bush, he ...

, pulled out of consideration in August 011, one account of the December nominations noted. The two other Obama nominees in 2011, Janet Yellen

Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th United States secretary of the treasury since January 26, 2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. Yellen is t ...

and Sarah Bloom Raskin, were confirmed in September. One of the vacancies was created in 2011 with the resignation of Kevin Warsh

Kevin Maxwell Warsh (born April 13, 1970) is an American financier and bank executive who served as a member of the Federal Reserve Board of Governors from 2006 to 2011. During and in the aftermath of the 2008 financial crisis, Warsh acted as t ...

, who took office in 2006 to fill the unexpired term ending January 31, 2018, and resigned his position effective March 31, 2011. In March 2012, U.S. Senator David Vitter

David Bruce Vitter (born May 3, 1961) is an American lobbyist, lawyer, and politician who served as United States Senator for Louisiana from 2005 to 2017.

A Republican, Vitter served in the Louisiana House of Representatives from 1992 to 1999. ...

( R, LA) said he would oppose Obama's Stein and Powell nominations, dampening near-term hopes for approval. However, Senate leaders reached a deal, paving the way for affirmative votes on the two nominees in May 2012 and bringing the board to full strength for the first time since 2006 with Duke's service after term end. Later, on January 6, 2014, the United States Senate confirmed Yellen's nomination to be chair of the Federal Reserve Board of Governors; she was the first woman to hold the position. Subsequently, President Obama nominated Stanley Fischer

Stanley Fischer ( he, סטנלי פישר; born October 15, 1943) is an Israeli American economist who served as the 20th Vice Chair of the Federal Reserve from 2014 to 2017. Fisher previously served as the 8th governor of the Bank of Israel fro ...

to replace Yellen as the vice-chair.

In April 2014, Stein announced he was leaving to return to Harvard May 28 with four years remaining on his term. At the time of the announcement, the FOMC "already is down three members as it awaits the Senate confirmation of ... Fischer and Lael Brainard

Lael Brainard (born January 1, 1962) is an American economist serving as the 22nd Vice Chair of the Federal Reserve since May 23, 2022. Prior to her term as vice chair, Brainard served as a member of the Federal Reserve Board of Governors since 2 ...

, and as resident

Resident may refer to:

People and functions

* Resident minister, a representative of a government in a foreign country

* Resident (medicine), a stage of postgraduate medical training

* Resident (pharmacy), a stage of postgraduate pharmaceuti ...

Obama has yet to name a replacement for ... Duke. ... Powell is still serving as he awaits his confirmation for a second term."

Allan R. Landon, former president and CEO of the Bank of Hawaii

The Bank of Hawaii Corporation ( haw, Panakō o Hawaii; abbreviated BOH) is a regional commercial bank headquartered in Honolulu, Hawaii. It is Hawaii's second oldest bank and its largest locally owned bank in that the majority of the voting sto ...

, was nominated in early 2015 by President Obama to the board.

In July 2015, President Obama nominated University of Michigan

, mottoeng = "Arts, Knowledge, Truth"

, former_names = Catholepistemiad, or University of Michigania (1817–1821)

, budget = $10.3 billion (2021)

, endowment = $17 billion (2021)As o ...

economist Kathryn M. Dominguez

Kathryn Mary Elizabeth Dominguez (born November 26, 1960) is a Professor of Public Policy and Economics at the University of Michigan and is a former nominee for the Governor of the U.S. Federal Reserve System.

Early life and education

Domingu ...

to fill the second vacancy on the board. The Senate had not yet acted on Landon's confirmation by the time of the second nomination.

Daniel Tarullo submitted his resignation from the board on February 10, 2017, effective on or around April 5, 2017.

Federal Open Market Committee

The Federal Open Market Committee (FOMC) consists of 12 members, seven from the board of governors and 5 of the regional Federal Reserve Bank presidents. The FOMC oversees and sets policy on open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial as ...

, the principal tool of national monetary policy. These operations affect the amount of Federal Reserve balances available to depository institutions, thereby influencing overall monetary and credit conditions. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets. The FOMC must reach consensus on all decisions. The president of the Federal Reserve Bank of New York is a permanent member of the FOMC; the presidents of the other banks rotate membership at two- and three-year intervals. All Regional Reserve Bank presidents contribute to the committee's assessment of the economy and of policy options, but only the five presidents who are then members of the FOMC vote on policy decisions. The FOMC determines its own internal organization and, by tradition, elects the chair of the board of governors as its chair and the president of the Federal Reserve Bank of New York as its vice chair. Formal meetings typically are held eight times each year in Washington, D.C. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion. The FOMC generally meets eight times a year in telephone consultations and other meetings are held when needed.

There is very strong consensus among economists against politicising the FOMC.

Federal Advisory Council

The Federal Advisory Council, composed of twelve representatives of the banking industry, advises the board on all matters within its jurisdiction.

Federal Reserve Banks

There are 12 Federal Reserve Banks, each of which is responsible for member banks located in its district. They are located in

There are 12 Federal Reserve Banks, each of which is responsible for member banks located in its district. They are located in Boston

Boston (), officially the City of Boston, is the state capital and most populous city of the Commonwealth of Massachusetts, as well as the cultural and financial center of the New England region of the United States. It is the 24th- mo ...

, New York

New York most commonly refers to:

* New York City, the most populous city in the United States, located in the state of New York

* New York (state), a state in the northeastern United States

New York may also refer to:

Film and television

* '' ...

, Philadelphia

Philadelphia, often called Philly, is the largest city in the Commonwealth of Pennsylvania, the sixth-largest city in the U.S., the second-largest city in both the Northeast megalopolis and Mid-Atlantic regions after New York City. Sinc ...

, Cleveland

Cleveland ( ), officially the City of Cleveland, is a city in the U.S. state of Ohio and the county seat of Cuyahoga County. Located in the northeastern part of the state, it is situated along the southern shore of Lake Erie, across the U.S. ...

, Richmond

Richmond most often refers to:

* Richmond, Virginia, the capital of Virginia, United States

* Richmond, London, a part of London

* Richmond, North Yorkshire, a town in England

* Richmond, British Columbia, a city in Canada

* Richmond, California, ...

, Atlanta

Atlanta ( ) is the capital and most populous city of the U.S. state of Georgia. It is the seat of Fulton County, the most populous county in Georgia, but its territory falls in both Fulton and DeKalb counties. With a population of 498,715 ...

, Chicago

(''City in a Garden''); I Will

, image_map =

, map_caption = Interactive Map of Chicago

, coordinates =

, coordinates_footnotes =

, subdivision_type = Country

, subdivision_name ...

, St. Louis

St. Louis () is the second-largest city in Missouri, United States. It sits near the confluence of the Mississippi and the Missouri Rivers. In 2020, the city proper had a population of 301,578, while the bi-state metropolitan area, which e ...

, Minneapolis

Minneapolis () is the largest city in Minnesota, United States, and the county seat of Hennepin County. The city is abundant in water, with thirteen lakes, wetlands, the Mississippi River, creeks and waterfalls. Minneapolis has its origins ...

, Kansas City

The Kansas City metropolitan area is a bi-state metropolitan area anchored by Kansas City, Missouri. Its 14 counties straddle the border between the U.S. states of Missouri (9 counties) and Kansas (5 counties). With and a population of more ...

, Dallas

Dallas () is the List of municipalities in Texas, third largest city in Texas and the largest city in the Dallas–Fort Worth metroplex, the List of metropolitan statistical areas, fourth-largest metropolitan area in the United States at 7.5 ...

, and San Francisco

San Francisco (; Spanish language, Spanish for "Francis of Assisi, Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the List of Ca ...

. The size of each district was set based upon the population distribution of the United States when the Federal Reserve Act was passed.

The charter and organization of each Federal Reserve Bank is established by law and cannot be altered by the member banks. Member banks do, however, elect six of the nine members of the Federal Reserve Banks' boards of directors.

Legal status of regional Federal Reserve Banks

The Federal Reserve Banks have an intermediate legal status, with some features of private corporations and some features of public federal agencies. The United States has an interest in the Federal Reserve Banks as tax-exempt federally created instrumentalities whose profits belong to the federal government, but this interest is not proprietary.[Kennedy C. Scott v. Federal Reserve Bank of Kansas City, et al.](_blank)

(8th Cir. 2005). In ''Lewis v. United States'',

(9th Cir. 1982).United States Court of Appeals for the Ninth Circuit

The United States Court of Appeals for the Ninth Circuit (in case citations, 9th Cir.) is the U.S. federal court of appeals that has appellate jurisdiction over the U.S. district courts in the following federal judicial districts:

* District ...

stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA he_Federal_Tort_Claims_Act.html" ;"title="Federal_Tort_Claims_Act.html" ;"title="he Federal Tort Claims Act">he Federal Tort Claims Act">Federal_Tort_Claims_Act.html" ;"title="he Federal Tort Claims Act">he Federal Tort Claims Act but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is ''Scott v. Federal Reserve Bank of Kansas City'',

Member banks

A member bank is a private institution and owns stock in its regional Federal Reserve Bank. All nationally chartered banks hold stock in one of the Federal Reserve Banks. State chartered banks may choose to be members (and hold stock in their regional Federal Reserve bank) upon meeting certain standards.

The amount of stock a member bank must own is equal to 3% of its combined capital and surplus. However, holding stock in a Federal Reserve bank is not like owning stock in a publicly traded company. These stocks cannot be sold or traded, and member banks do not control the Federal Reserve Bank as a result of owning this stock. From their Regional Bank, member banks with $10 billion or less in assets receive a dividend of 6%, while member banks with more than $10 billion in assets receive the lesser of 6% or the current 10-year Treasury auction rate. The remainder of the regional Federal Reserve Banks' profits is given over to the United States Treasury Department. In 2015, the Federal Reserve Banks made a profit of $100.2 billion and distributed $2.5 billion in dividends to member banks as well as returning $97.7 billion to the U.S. Treasury.

Accountability

An external auditor selected by the audit committee of the Federal Reserve System regularly audits the Board of Governors and the Federal Reserve Banks. The GAO will audit some activities of the Board of Governors. These audits do not cover "most of the Fed's monetary policy actions or decisions, including discount window lending (direct loans to financial institutions), open-market operations and any other transactions made under the direction of the Federal Open Market Committee" ...or may the GAO audit

Or or OR may refer to:

Arts and entertainment Film and television

* "O.R.", a 1974 episode of M*A*S*H

* Or (My Treasure), a 2004 movie from Israel (''Or'' means "light" in Hebrew)

Music

* ''Or'' (album), a 2002 album by Golden Boy with Mis ...

"dealings with foreign governments and other central banks."

The annual and quarterly financial statements prepared by the Federal Reserve System conform to a basis of accounting that is set by the Federal Reserve Board and does not conform to Generally Accepted Accounting Principles (GAAP) or government Cost Accounting Standards (CAS). The financial reporting standards are defined in the Financial Accounting Manual for the Federal Reserve Banks.Bloomberg L.P.

Bloomberg L.P. is a privately held financial, software, data, and media company headquartered in Midtown Manhattan, New York City. It was co-founded by Michael Bloomberg in 1981, with Thomas Secunda, Duncan MacMillan (Bloomberg), Duncan MacMi ...

News brought a lawsuit against the board of governors of the Federal Reserve System to force the board to reveal the identities of firms for which it has provided guarantees during the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

. Bloomberg, L.P. won at the trial court and the Fed's appeals were rejected at both the United States Court of Appeals for the Second Circuit

The United States Court of Appeals for the Second Circuit (in case citations, 2d Cir.) is one of the thirteen United States Courts of Appeals. Its territory comprises the states of Connecticut, New York and Vermont. The court has appellate juri ...

and the U.S. Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point o ...

. The data was released on March 31, 2011.

Monetary policy

The term "monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

" refers to the actions undertaken by a central bank, such as the Federal Reserve, to influence the availability and cost of money and credit to help promote national economic goals. What happens to money and credit affects interest rates (the cost of credit) and the performance of an economy. The Federal Reserve Act of 1913

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Pani ...

gave the Federal Reserve authority to set monetary policy in the United States.

Interbank lending

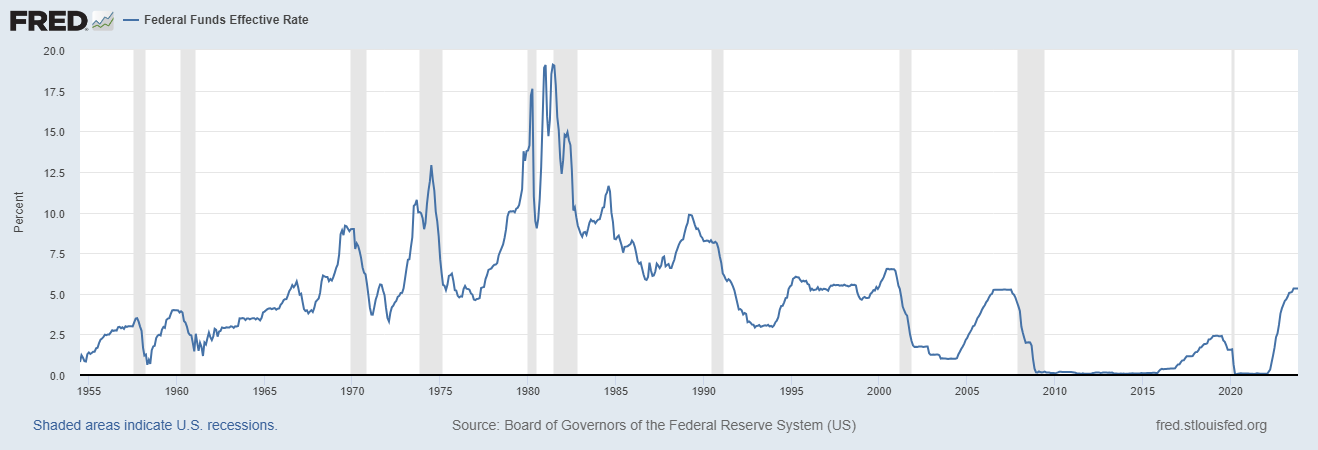

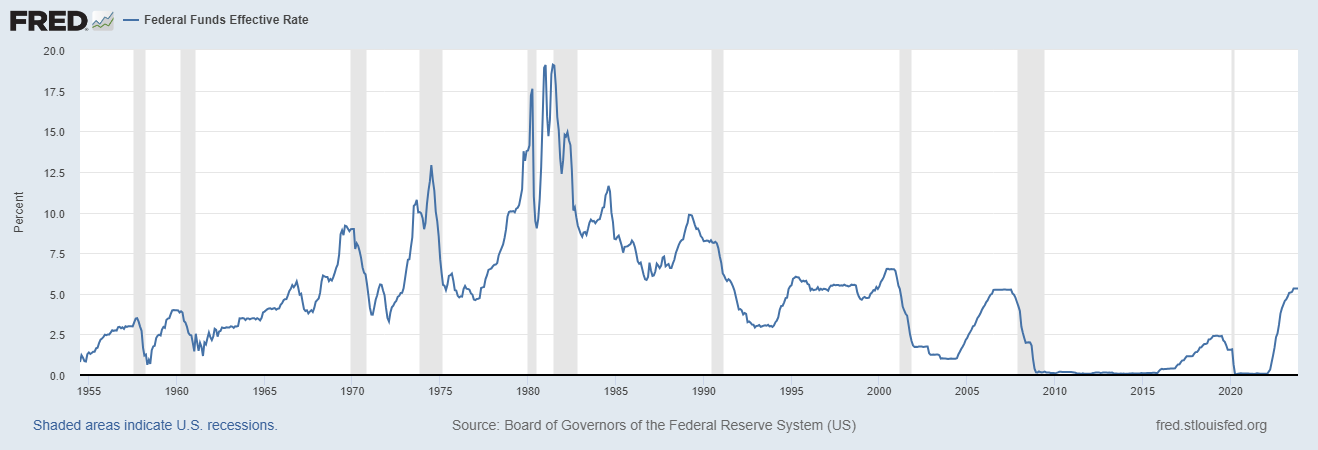

The Federal Reserve sets monetary policy by influencing the federal funds rate, which is the rate of interbank lending of excess reserves. The rate that banks charge each other for these loans is determined in the interbank lending market, interbank market and the Federal Reserve influences this rate through the three "tools" of monetary policy described in the Federal Reserve System#Monetary policy, ''Tools'' section below. The federal funds rate is a short-term interest rate that the FOMC focuses on, which affects the longer-term interest rates throughout the economy. The Federal Reserve summarized its monetary policy in 2005:

Effects on the quantity of reserves that banks used to make loans influence the economy. Policy actions that add reserves to the banking system encourage lending at lower interest rates thus stimulating growth in money, credit, and the economy. Policy actions that absorb reserves work in the opposite direction. The Fed's task is to supply enough reserves to support an adequate amount of money and credit, avoiding the excesses that result in inflation and the shortages that stifle economic growth.

Tools

There are three main tools of monetary policy that the Federal Reserve uses to influence the amount of reserves in private banks:

Federal funds rate and open market operations

The Federal Reserve System implements

The Federal Reserve System implements monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

largely by targeting the federal funds rate. This is the interest rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. This rate is actually determined by the market and is not explicitly mandated by the Fed. The Fed therefore tries to align the effective federal funds rate with the targeted rate by adding or subtracting from the money supply through open market operations. The Federal Reserve System usually adjusts the federal funds rate target by 0.25% or 0.50% at a time.

Open market operations allow the Federal Reserve to increase or decrease the amount of money in the banking system as necessary to balance the Federal Reserve's dual mandates. Open market operations are done through the sale and purchase of United States Treasury security, sometimes called "Treasury bills" or more informally "T-bills" or "Treasuries". The Federal Reserve buys Treasury bills from its primary dealers. The purchase of these securities affects the federal funds rate, because primary dealers have accounts at depository institutions.

= Repurchase agreements

=

To smooth temporary or cyclical changes in the money supply, the desk engages in repurchase agreements (repos) with its primary dealers. Repos are essentially secured, short-term lending by the Fed. On the day of the transaction, the Fed deposits money in a Primary dealers, primary dealer's reserve account, and receives the promised securities as collateral (finance), collateral. When the transaction matures, the process unwinds: the Fed returns the collateral and charges the primary dealer's reserve account for the principal and accrued interest. The term of the repo (the time between settlement and maturity) can vary from 1 day (called an overnight repo) to 65 days.

Discount rate

The Federal Reserve System also directly sets the discount rate (a.k.a. the policy rate), which is the interest rate for "discount window lending", overnight loans that member banks borrow directly from the Fed. This rate is generally set at a rate close to 100 basis points above the target federal funds rate. The idea is to encourage banks to seek alternative funding before using the "discount rate" option. The equivalent operation by the European Central Bank is referred to as the "marginal lending facility".

Both the discount rate and the federal funds rate influence the prime rate, which is usually about 3 percentage points higher than the federal funds rate.

Reserve requirements

Another instrument of monetary policy adjustment historically employed by the Federal Reserve System was the fractional reserve requirement, also known as the required reserve ratio. The required reserve ratio sets the balance that the Federal Reserve System requires a depository institution to hold in the Federal Reserve Banks,

New facilities

In order to address problems related to the subprime mortgage crisis and United States housing bubble, several new tools have been created. The first new tool, called the Term auction Facility, was added on December 12, 2007. It was first announced as a temporary toolGreat Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. The Federal Reserve gives a brief summary of these new facilities:

A fourth facility, the Term Deposit Facility, was announced December 9, 2009, and approved April 30, 2010, with an effective date of June 4, 2010. The Term deposit Facility allows Reserve Banks to offer term deposits to institutions that are eligible to receive earnings on their balances at Reserve Banks. Term deposits are intended to facilitate the implementation of monetary policy by providing a tool by which the Federal Reserve can manage the aggregate quantity of reserve balances held by depository institutions. Funds placed in term deposits are removed from the accounts of participating institutions for the life of the term deposit and thus drain reserve balances from the banking system.

= Term auction facility

=

The Term auction Facility is a program in which the Federal Reserve auctions term funds to depository institutions.

= Term securities lending facility

=

The Term securities Lending Facility is a 28-day facility that will offer Treasury general collateral to the Federal Reserve Bank of New York's primary dealers in exchange for other program-eligible collateral. It is intended to promote liquidity in the financing markets for Treasury and other collateral and thus to foster the functioning of financial markets more generally.

= Primary dealer credit facility

=

The Primary Dealer Credit Facility (PDCF) is an overnight loan facility that will provide funding to primary dealers in exchange for a specified range of eligible collateral and is intended to foster the functioning of financial markets more generally.[ This new facility marks a fundamental change in Federal Reserve policy because now primary dealers can borrow directly from the Fed when this used to be prohibited.

]

= Interest on reserves

=

, the Federal Reserve banks will pay interest on reserve balances (required and excess) held by depository institutions. The rate is set at the lowest federal funds rate during the reserve maintenance period of an institution, less 75basis point, bp. , the Fed has lowered the spread to a mere 35 bp.

= Term Deposit facility

=

The Term Deposit facility is a program through which the Federal Reserve Banks offer interest-bearing time deposit, term deposits to eligible institutions. Fed Chair Ben S. Bernanke, testifying before the House Committee on Financial Services, stated that the Term Deposit Facility would be used to reverse the expansion of credit during the Great Recession, by drawing funds out of the money markets into the Federal Reserve Banks. It would therefore result in increased market interest rates, acting as a brake on economic activity and inflation. The Federal Reserve authorized up to five "small-value offerings" in 2010 as a pilot program. After three of the offering auctions were successfully completed, it was announced that small-value auctions would continue on an ongoing basis.

= Asset Backed Commercial Paper Money Market Mutual Fund Liquidity Facility

=

The Asset Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (ABCPMMMFLF) was also called the AMLF. The Facility began operations on September 22, 2008, and was closed on February 1, 2010.

All U.S. depository institutions, bank holding companies (parent companies or U.S. broker-dealer affiliates), or U.S. branches and agencies of foreign banks were eligible to borrow under this facility pursuant to the discretion of the FRBB.

Collateral eligible for pledge under the Facility was required to meet the following criteria:

* was purchased by Borrower on or after September 19, 2008 from a registered investment company that held itself out as a money market mutual fund;

* was purchased by Borrower at the Fund's acquisition cost as adjusted for amortization of premium or accretion of discount on the ABCP through the date of its purchase by Borrower;

* was rated at the time pledged to FRBB, not lower than A1, F1, or P1 by at least two major rating agencies or, if rated by only one major rating agency, the ABCP must have been rated within the top rating category by that agency;

* was issued by an entity organized under the laws of the United States or a political subdivision thereof under a program that was in existence on September 18, 2008; and

* had stated maturity that did not exceed 120 days if the Borrower was a bank or 270 days for non-bank Borrowers.

= Commercial Paper Funding Facility

=

On October 7, 2008, the Federal Reserve further expanded the collateral it will loan against to include commercial paper using the new Commercial Paper Funding Facility (CPFF). The action made the Fed a crucial source of credit for non-financial businesses in addition to commercial banks and investment firms. Fed officials said they'll buy as much of the debt as necessary to get the market functioning again. They refused to say how much that might be, but they noted that around $1.3 trillion worth of commercial paper would qualify. There was $1.61 trillion in outstanding commercial paper, seasonally adjusted, on the market , according to the most recent data from the Fed. That was down from $1.70 trillion in the previous week. Since the summer of 2007, the market has shrunk from more than $2.2 trillion. This program lent out a total $738 billion before it was closed. Forty-five out of 81 of the companies participating in this program were foreign firms. Research shows that Troubled Asset Relief Program (TARP) recipients were twice as likely to participate in the program than other commercial paper issuers who did not take advantage of the TARP bailout. The Fed incurred no losses from the CPFF.

Quantitative Easing (QE) policy

A little-used tool of the Federal Reserve is the quantitative easing policy. Under that policy, the Federal Reserve buys back corporate bonds and mortgage backed securities held by banks or other financial institutions. This in effect puts money back into the financial institutions and allows them to make loans and conduct normal business.

The bursting of the United States housing bubble prompted the Fed to buy mortgage-backed securities for the first time in November 2008. Over six weeks, a total of $1.25 trillion were purchased in order to stabilize the housing market, about one-fifth of all U.S. government-backed mortgages.

History

Central banking in the United States, 1791–1913

The first attempt at a national currency was during the American Revolutionary War. In 1775, the Continental Congress, as well as the states, began issuing paper currency, calling the bills "Early American currency, Continentals". The Continentals were backed only by future tax revenue, and were used to help finance the Revolutionary War. Overprinting, as well as British counterfeiting, caused the value of the Continental to diminish quickly. This experience with paper money led the United States to strip the power to issue Bills of Credit (paper money) from a draft of the new Constitution on August 16, 1787, as well as banning such issuance by the various states, and limiting the states' ability to make anything but gold or silver coin legal tender on August 28.

In 1791, the government granted the First Bank of the United States a charter to operate as the U.S. central bank until 1811.

First Central Bank, 1791 and Second Central Bank, 1816

The first U.S. institution with central banking responsibilities was the First Bank of the United States, chartered by Congress and signed into law by President George Washington on February 25, 1791, at the urging of Alexander Hamilton. This was done despite strong opposition from Thomas Jefferson and James Madison, among numerous others. The charter was for twenty years and expired in 1811 under President Madison, when Congress refused to renew it.

Creation of Third Central Bank, 1907–1913

The main motivation for the third central banking system came from the Panic of 1907, which caused a renewed desire among legislators, economists, and bankers for an overhaul of the monetary system.Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

. The House voted on December 22, 1913, with 298 voting yes to 60 voting no. The Senate voted 43–25 on December 23, 1913. President Woodrow Wilson signed the bill later that day.

= Federal Reserve Act, 1913

=

The head of the bipartisan National Monetary Commission was financial expert and Senate Republican Party (United States), Republican leader Nelson Aldrich. Aldrich set up two commissions – one to study the American monetary system in depth and the other, headed by Aldrich himself, to study the European central banking systems and report on them.

The head of the bipartisan National Monetary Commission was financial expert and Senate Republican Party (United States), Republican leader Nelson Aldrich. Aldrich set up two commissions – one to study the American monetary system in depth and the other, headed by Aldrich himself, to study the European central banking systems and report on them.

Federal Reserve era, 1913–present

Key laws affecting the Federal Reserve have been:

* Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, 1913

* Glass–Steagall Act, 1933

* Banking Act of 1935

* Employment Act of 1946

* 1951 Accord, Federal Reserve-Treasury Department Accord of 1951

* Bank Holding Company Act of 1956 and the amendments of 1970

* Federal Reserve Reform Act of 1977

* International Banking Act of 1978

* Full Employment and Balanced Growth Act (1978)

* Depository Institutions Deregulation and Monetary Control Act

The Depository Institutions Deregulation and Monetary Control Act of 1980 (, ) (often abbreviated DIDMCA or MCA) is a United States federal financial statute passed in 1980 and signed by President Jimmy Carter on March 31. It gave the Federal Res ...

(1980)

* Financial Institutions Reform, Recovery and Enforcement Act of 1989

* Federal Deposit Insurance Corporation Improvement Act of 1991

* Gramm–Leach–Bliley Act (1999)

* Financial Services Regulatory Relief Act (2006)

* Emergency Economic Stabilization Act (2008)

* Dodd–Frank Wall Street Reform and Consumer Protection Act (2010)

Measurement of economic variables

The Federal Reserve records and publishes large amounts of data. A few websites where data is published are at the board of governors' Economic Data and Research page, the board of governors' statistical releases and historical data page, and at the St. Louis Fed's FRED (Federal Reserve Economic Data) page. The Federal Open Market Committee, Federal Open Market Committee (FOMC) examines many economic indicators prior to determining monetary policy.

Net worth of households and nonprofit organizations

The net worth of households and nonprofit organizations in the United States is published by the Federal Reserve in a report titled ''Flow of Funds''. At the end of the third quarter of fiscal year 2012, this value was $64.8 trillion. At the end of the first quarter of fiscal year 2014, this value was $95.5 trillion.

The net worth of households and nonprofit organizations in the United States is published by the Federal Reserve in a report titled ''Flow of Funds''. At the end of the third quarter of fiscal year 2012, this value was $64.8 trillion. At the end of the first quarter of fiscal year 2014, this value was $95.5 trillion.

Money supply

The most common measures are named M0 (narrowest), M1, M2, and M3. In the United States they are defined by the Federal Reserve as follows:

The Federal Reserve stopped publishing M3 statistics in March 2006, saying that the data cost a lot to collect but did not provide significantly useful information.

The Federal Reserve stopped publishing M3 statistics in March 2006, saying that the data cost a lot to collect but did not provide significantly useful information.

Personal consumption expenditures price index

The Personal consumption expenditures price index, also referred to as simply the PCE price index, is used as one measure of the value of money. It is a United States-wide indicator of the average increase in prices for all domestic personal consumption. Using a variety of data including United States Consumer Price Index and U.S. Producer Price Index prices, it is derived from the largest component of the gross domestic product in the BEA's National Income and Product Accounts, personal consumption expenditures.

One of the Fed's main roles is to maintain price stability, which means that the Fed's ability to keep a low inflation rate is a long-term measure of their success. Although the Fed is not required to maintain inflation within a specific range, their long run target for the growth of the PCE price index is between 1.5 and 2 percent. There has been debate among policy makers as to whether the Federal Reserve should have a specific inflation targeting policy.

Inflation and the economy

Most mainstream economists favor a low, steady rate of inflation.monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authority, monetary authorities.

Unemployment rate

One of the stated goals of monetary policy is maximum employment. The unemployment rate statistics are collected by the Bureau of Labor Statistics, and like the PCE price index are used as a barometer of the nation's economic health.

One of the stated goals of monetary policy is maximum employment. The unemployment rate statistics are collected by the Bureau of Labor Statistics, and like the PCE price index are used as a barometer of the nation's economic health.

Budget

The Federal Reserve is self-funded. The vast majority (90%+) of Fed revenues come from open market operations, specifically the interest on the portfolio of Treasury securities as well as "capital gains/losses" that may arise from the buying/selling of the securities and their derivatives as part of Open Market Operations. The balance of revenues come from sales of financial services (check and electronic payment processing) and discount window loans. The board of governors (Federal Reserve Board) creates a budget report once per year for Congress. There are two reports with budget information. The one that lists the complete balance statements with income and expenses, as well as the net profit or loss, is the large report simply titled, "Annual Report". It also includes data about employment throughout the system. The other report, which explains in more detail the expenses of the different aspects of the whole system, is called "Annual Report: Budget Review". These detailed comprehensive reports can be found at the board of governors' website under the section "Reports to Congress"

Remittence payments to the Treasury

The Federal Reserve has been remitting interest that it has been receiving back to the United States Treasury. Most of the assets the Fed holds are United States Treasury security, U.S. Treasury bonds and then mortgage backed securities that it has been purchasing as part of quantitative easing since the Financial crisis of 2007–2008, 2008 Financial Crisis. In 2022 the Fed started quantitative tightening and selling these assets and taking a loss on them in the secondary market, secondary bond market so the $100 billion Dollars that it was remitting annually to the Treasury, likely won't happen during Quantitative tightening, QT.

The Federal Reserve has been remitting interest that it has been receiving back to the United States Treasury. Most of the assets the Fed holds are United States Treasury security, U.S. Treasury bonds and then mortgage backed securities that it has been purchasing as part of quantitative easing since the Financial crisis of 2007–2008, 2008 Financial Crisis. In 2022 the Fed started quantitative tightening and selling these assets and taking a loss on them in the secondary market, secondary bond market so the $100 billion Dollars that it was remitting annually to the Treasury, likely won't happen during Quantitative tightening, QT.

Balance sheet

One of the keys to understanding the Federal Reserve is the Federal Reserve balance sheet (or Balance sheet, balance statement). In accordance with Section 11 of the

One of the keys to understanding the Federal Reserve is the Federal Reserve balance sheet (or Balance sheet, balance statement). In accordance with Section 11 of the Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, the board of governors of the Federal Reserve System publishes once each week the "Consolidated Statement of Condition of All Federal Reserve Banks" showing the condition of each Federal Reserve bank and a consolidated statement for all Federal Reserve banks. The board of governors requires that excess earnings of the Reserve Banks be transferred to the Treasury as interest on Federal Reserve notes.

The Federal Reserve releases its balance sheet every Thursday.

Criticism

The Federal Reserve System has faced various criticisms since its inception in 1913. Criticisms include lack of Federal Reserve Transparency Act, transparency and claims that it is ineffective.

The Federal Reserve System has faced various criticisms since its inception in 1913. Criticisms include lack of Federal Reserve Transparency Act, transparency and claims that it is ineffective.[; ]

See also

* Consumer leverage ratio

* Core inflation

* Farm Credit System

* Fed model

* Federal Home Loan Banks

* Federal Reserve Police

* Federal Reserve Statistical Release

* Free banking

* Gold standard

* Government debt

* Greenspan put

* History of Federal Open Market Committee actions

* History of central banking in the United States

* Independent Treasury

* Legal Tender Cases

* List of economic reports by U.S. government agencies

* Securities market participants (United States)

* Title 12 of the Code of Federal Regulations

* United States Bullion Depositoryknown as Fort Knox

References

Bundled references

Bibliography

Recent

* Sarah Binder & Mark Spindel. 2017. ''The Myth of Independence: How Congress Governs the Federal Reserve''. Princeton University Press.

*

* from the St. Louis Fed

* Congressional Research Service]

Changing the Federal Reserve's Mandate: An Economic Analysis

* Congressional Research Service]

Federal Reserve: Unconventional Monetary Policy Options

* Conti-Brown, Peter. ''The Power and Independence of the Federal Reserve'' (Princeton University Press, 2016).

* Epstein, Lita & Martin, Preston (2003). ''The Complete Idiot's Guide to the Federal Reserve''. Alpha Books. .

* William Greider, Greider, William (1987). ''Secrets of the Temple''. Simon & Schuster. ; nontechnical book explaining the structures, functions, and history of the Federal Reserve, focusing specifically on the tenure of Paul Volcker

* Hafer, R. W. ''The Federal Reserve System: An Encyclopedia''. Greenwood Press, 2005. 451 pp, 280 entries; .

* Laurence Meyer, Meyer, Laurence H. (2004). ''A Term at the Fed: An Insider's View''. HarperBusiness. ; focuses on the period from 1996 to 2002, emphasizing Alan Greenspan's chairmanship during the 1997 Asian financial crisis, the Dot-com bubble, stock market boom and the September 11, 2001 attacks#Economic aftermath, financial aftermath of the September 11, 2001 attacks.

* Woodward, Bob. ''Maestro: Greenspan's Fed and the American Boom'' (2000) study of Greenspan in the 1990s.

Historical

*

*

*

*

*

*

*

* Livingston, James. ''Origins of the Federal Reserve System: Money, Class, and Corporate Capitalism, 1890–1913'' (1986)

*

*

* Mayhew, Anne. "Ideology and the Great Depression: Monetary History Rewritten". ''Journal of Economic Issues'' 17 (June 1983): 353–360.

* (cloth) and (paper)

**

**

* Mullins, Eustace C. ''The Secrets of the Federal Reserve'', 1952. John McLaughlin.

* Roberts, Priscilla. 'Quis Custodiet Ipsos Custodes?' The Federal Reserve System's Founding Fathers and Allied Finances in the First World War", ''Business History Review'' (1998) 72: 585–603

*

* Shull, Bernard. "The Fourth Branch: The Federal Reserve's Unlikely Rise to Power and Influence" (2005)

* Steindl, Frank G. ''Monetary Interpretations of the Great Depression.'' (1995).

*

* Wells, Donald R. ''The Federal Reserve System: A History'' (2004)

* West, Robert Craig. ''Banking Reform and the Federal Reserve, 1863–1923'' (1977)

* Wicker, Elmus. "A Reconsideration of Federal Reserve Policy during the 1920–1921 Depression", ''Journal of Economic History'' (1966) 26: 223–238

** Wicker, Elmus. ''Federal Reserve Monetary Policy, 1917–33.'' (1966).

** Wicker, Elmus. ''The Great Debate on Banking Reform: Nelson Aldrich and the Origins of the Fed'' Ohio State University Press, 2005.

* Wood, John H. ''A History of Central Banking in Great Britain and the United States'' (2005)

* Wueschner; Silvano A. ''Charting Twentieth-Century Monetary Policy: Herbert Hoover and Benjamin Strong, 1917–1927'' Greenwood Press. (1999)

External links

*

Federal Reserve System

in the Federal Register

Records of the Federal Reserve System in the National Archives (Record Group 82)

{{DEFAULTSORT:Federal Reserve

Federal Reserve System,

1913 establishments in Washington, D.C.

Bank regulation in the United States

Banks established in 1913

Central banks, United States

Government agencies established in 1913

Independent agencies of the United States government

In its role as the